Navigating Gene Therapy Coverage - Self-Insured Employers

1. Overview of Self-insured Employers

Self-insured employers pay their employees' medical claims from their balance sheets, effectively acting as insurers for their employees and dependents. The self-insured model offers employers greater control over their healthcare costs and plan designs.

According to the latest Kaiser report1, approximately 120 million individuals in the United States currently receive coverage from self-insured employers through Administrative Services Only (ASO) or Third-Party Administrator (TPA) plans. This market covers over 40% of gene therapy patients.

Between 1999 and 2023, the percentage of employees with self-insured coverage rose from 44% to 65%2, largely driven by the Affordable Care Act (ACA) which encouraged this model. Today, companies with as few as 100 employees and an annual healthcare budget of less than $1 million choose to go self-insured to manage rising healthcare costs.

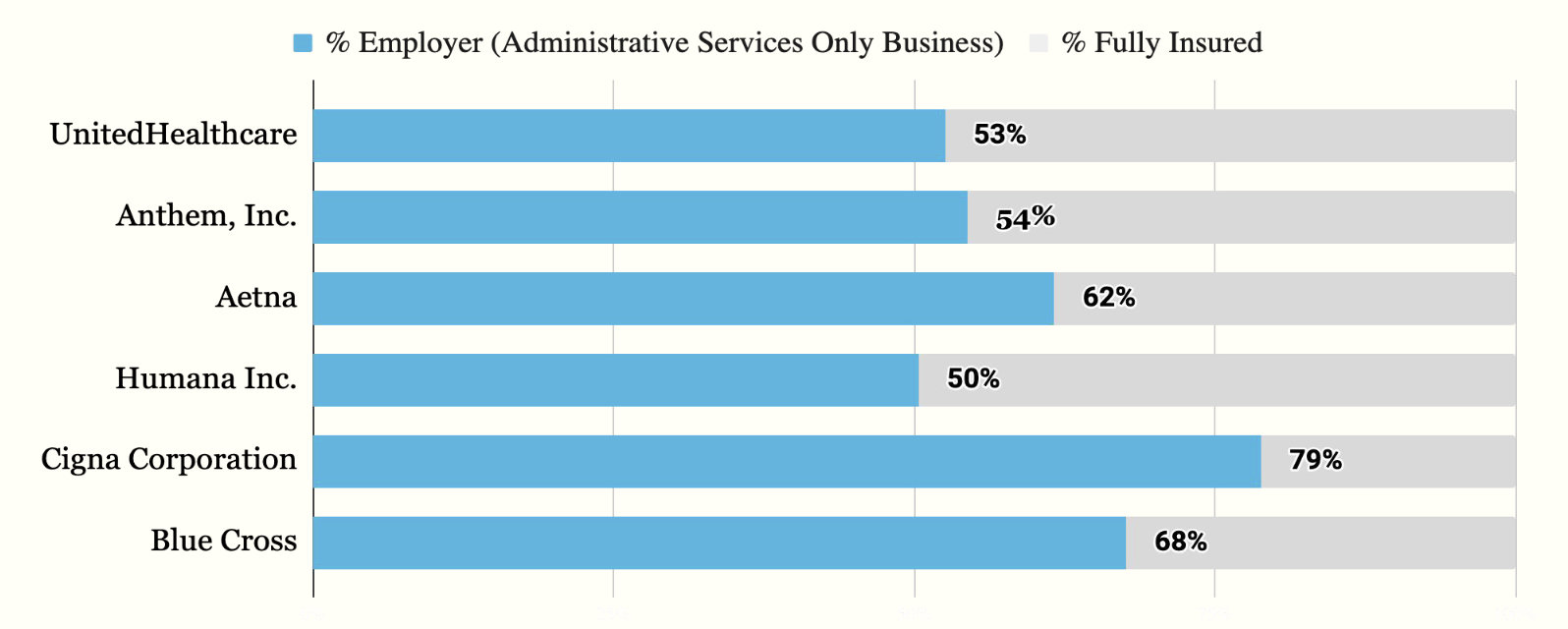

2. Understanding National Plan’s ASO Employer Business

Source: Latest AIS’s Directory of Health Plans.

According to AIS’s health plan directory, 67% of self-insured lives are covered through Administrative Services Only (ASO) arrangements with insurance companies. Across the major insurers, self-insured lives represent over 50% of their total covered lives. This allows employers who fund these plans to exclude gene therapy coverage, even if the insurance company includes it in their standard offering.

3. How Employers Make Benefit Decisions

HR leaders and benefits consultants at self-insured employers are the ultimate decision makers when it comes to shaping the healthcare benefits offered to their employees. They base these decisions on their budget and the financial risk they can manage each year.

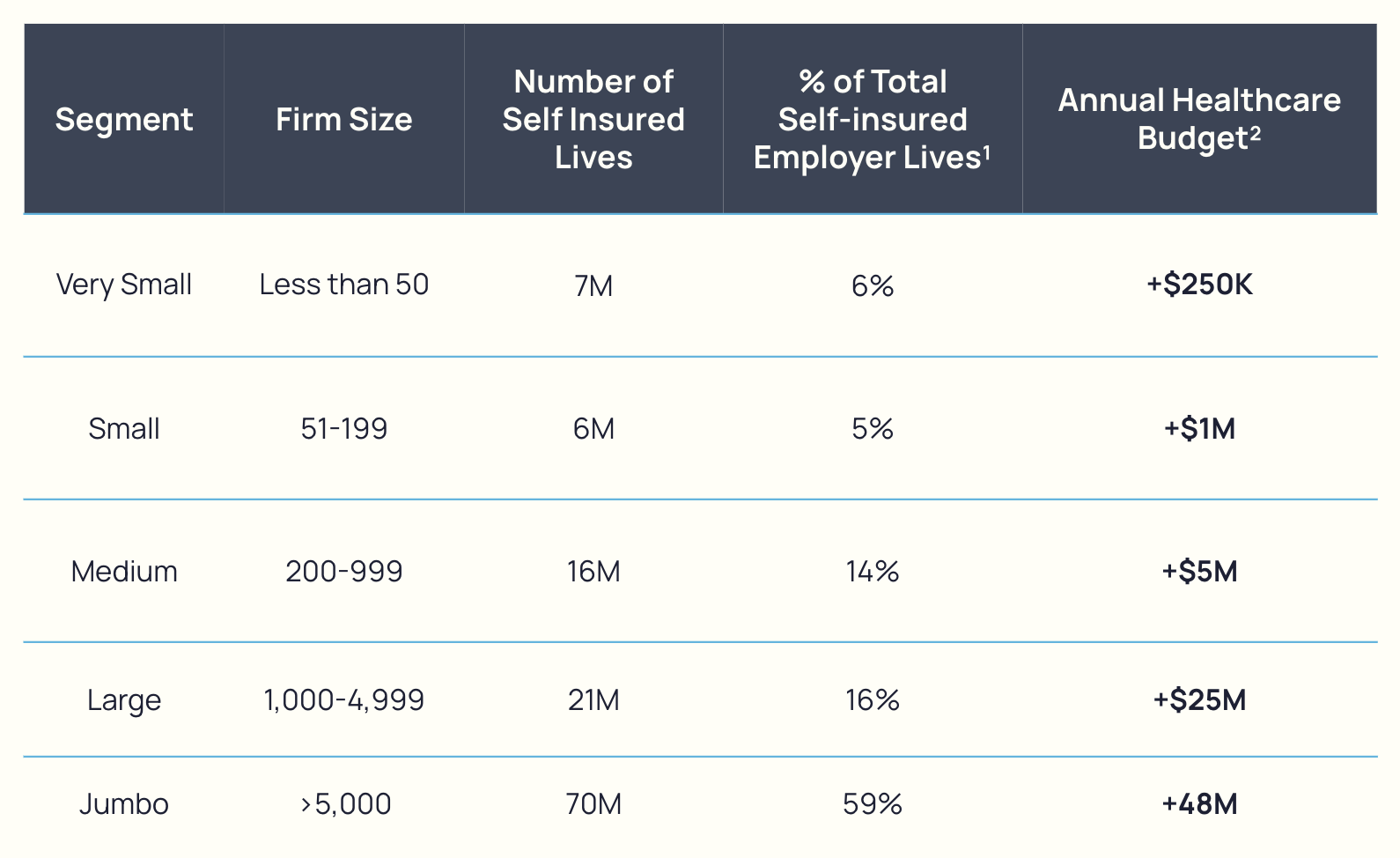

4. Gene Therapy Budgeting Impact on Self-insured Employers, By Firm Size

Sources: ¹Latest SUSB Census Data. ²2023 KFF Benefits Survey.

Given that a single dose of gene therapy can consume a substantial portion of the budget for an employer with fewer than 500 employees, many employers opt to drop gene therapy coverage to avoid catastrophic financial risk. Our survey of over 1,000 employers and benefits decision-makers found that over 30% of smaller self-insured employers currently restrict access to these treatments. As more gene therapies receive FDA approval, this trend is expected to accelerate, prompting more employers to drop coverage altogether.