Examining Trends in Patient Adoption of Approved Gene Therapies

Overview

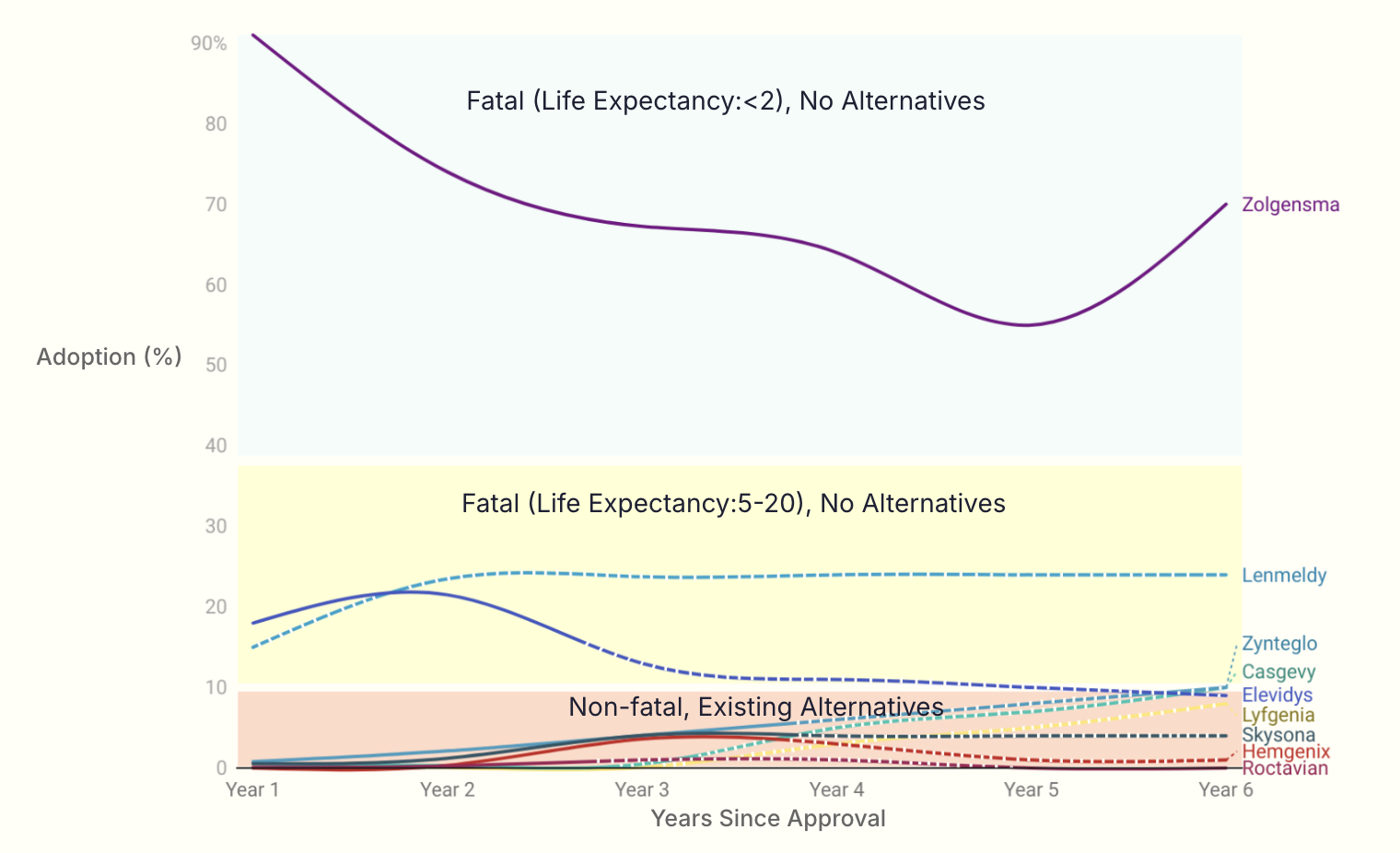

Since the approval of the first gene therapy in the U.S. in 2017, the landscape has rapidly evolved, with over 2,500 trials currently in the pipeline and 12 expected to be approved in 2025. These therapies address a range of conditions, from ultra-rare diseases to more prevalent ones. Our team conducted an analysis to understand patient adoption since the initial approvals and made predictions on future adoption. We found that patient adoption is significantly influenced by disease severity and the availability of treatment alternatives falling into three distinct categories.

Methodology

Gene Therapy Trend Assumptions

Elevidys: In Years 1 and 2, adoption is based on the initial label for ambulatory boys with DMD ages 4-5. In Year 3, a label expansion to include both ambulatory and non-ambulatory patients of all ages significantly increased the eligible patient pool. As a result, adoption trends will decrease in Year 3 and continue to Year 6 as alternative treatments are approved.

Lenmeldy: There is currently no sales data available for Lenmeldy. Years 1 to 6 are trends based on historical sales of Libmeldy (its EU counterpart). Given the ultra-rare nature of the disease and the fact that Lenmeldy is the only available treatment, adoption is expected to increase post approval until Year 3 and then Years 4 to 6 will remain flat.

Zynteglo: Adoption is projected to increase slowly from Years 4 to 6 due to historically slow patient starts, the lengthy treatment process, and eligible patient pool for Beta Thalassemia.

Casgevy: Patient adoption is based on quicker than expected patient starts. Given the long treatment process, the number of eligible patient pool for Beta Thalassemia and Sickle Cell Disease, we assume increased patient adoption from Years 4 to 6.

Lyfgenia: Similar to Zynteglo, adoption will increase slowly from Years 4 to 6 due to historically slow patient starts, the lengthy treatment process, and the number of eligible Sickle Cell Disease patients.

Hemgenix: Patient adoption is expected to decrease in Years 4 to 6 as more alternative Hemophilia B treatments become available.

Skysona: Adoption will remain flat, consistent with Bluebird’s historical patient start rates and the ultra-rare nature of the disease.

Roctavian: A slight increase in patient adoption is expected in Year 3 as the company focuses on the U.S. market. However, adoption is anticipated to decline thereafter due to competition from alternative Hemophilia treatments and the smaller patient pool of severe Hemophilia A patients.